Frank Schliewinsky

Other

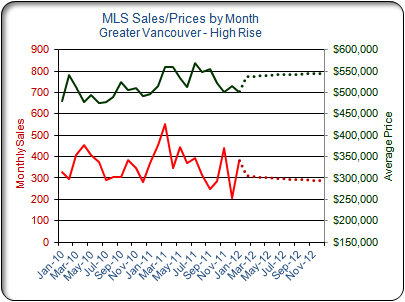

High Rise Market

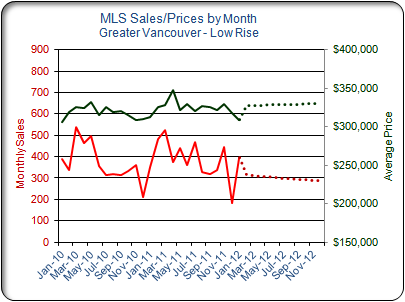

Low Rise Market

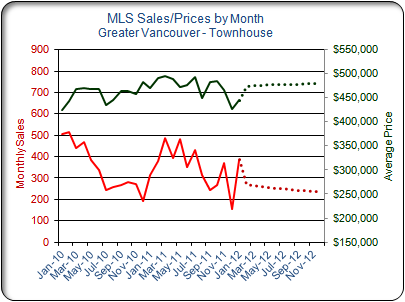

Townhouse Market

January MLS sales indicate that there will be a seasonal upswing in apartment and townhouse condo sales. But after the first quarter? The markets to watch are Westside Vancouver and Richmond.

Luxury high rise buyers are still active in the Westside MLS market and $million plus sales still make up over 20% of MLS high rise sales. If this number starts to drop in the coming months, it’ll be a sure indication that China’s troubled real estate market is starting to take a bite out of the high priced Vancouver market.

This may already be happening in Richmond. Both apartment and townhome MLS sales trends are down in Richmond and sales in January have not reversed this trend. Over the past few years, the Richmond market has grown on the strength of immigration to the Lower Mainland. With net migration figures to BC off by 8%, which could mean a 10% drop in apartment and townhouse demand, Richmond appears to be taking the brunt of the decline in apartment and townhouse demand.

High Rise Market

The 380 MLS high rise sales in January were almost the same as they were in January 2011 so a first quarter seasonal upswing appears to be in the cards.

But what happens to high rise sales during the rest of 2012 is still uncertain. The Westside Vancouver high rise market is still attracting well-heeled luxury buyers. More than 20% of the MLS high rise sales over the past three months had an average price of $1.2 million. However, January MLS high rise sales in Richmond are down sharply from one year ago. MLS sales in the Downtown high rise market in January were up, largely on strong sales of units under 600 square feet.

The average MLS selling price for high rise condos is still down from its high last July. The average selling price of $501,000 in January was up by 1% from 12 months ago. This may be an indication that in the year of the dragon, sellers will have difficulty in draggin‘ more money out of buyers.

Over the past three months the average high rise condo has taken 53 days to sell on MLS. Average selling prices have been 4% below the list price. Million dollar plus high rise units have had to drop their price by an average of 6% to make a sale.

Low Rise Market

January MLS low rise sales were up from 12 months ago and the 395 sales were better than in January 2011 or 2010. So the market is improving? Maybe. But the overall MLS low rise sales trend is still negative. MLS low rise sales trends in Burnaby and especially Richmond are down. The increase in January sales is largely on the strength of sales in Coquitlam-Port Moody-PoCo and North Surrey.

And product priced under $300,000 has made up most of the recent MLS low rise sales. The average MLS selling price for low rise condos in January was $309,000; down by 1% from 12 months ago.

At the end of January, the Greater Vancouver market had over 8,600 active low rise listings, so plenty of choice for buyers. The average low rise condo is taking about 58 days to sell on MLS. The average selling price is 4% below the list price.

Townhouse Market

MLS townhouse sales too, were up in January. The 386 sales during the month were up by 23% from 12 months ago largely on the strength of a sharp increase in North Surrey townhouse sales. North Surrey townhouse sales were over 100 units in January, something this market hasn’t managed to do in the past 18 months.

The average MLS selling price for townhouse condos in January was $445,000; down by 5% from 12 months ago. Most of the townhouses sold over the past three months are in the 1,250 to 1,750 square foot range but sales of smaller stacked units is quite strong. Sales of the smaller units could probably be better if there was more supply.

This Greater Vancouver Condominium Market Overview is compiled by Strategics, a Vancouver-based company providing information and analysis since 1981 helping to minimize marketing risk for apartment condominium developers, lenders, project marketers and investors.

© 2011 REW. All rights reserved.