Post-industrial wave washes over Mount Pleasant?s buildings

Evan Duggan

The Vancouver Sun

New developments that are blending light industry with office space in Mount Pleasant are accelerating the transformation of a neighbourhood once known more for its elbow grease shops than the digital commerce emerging there today.

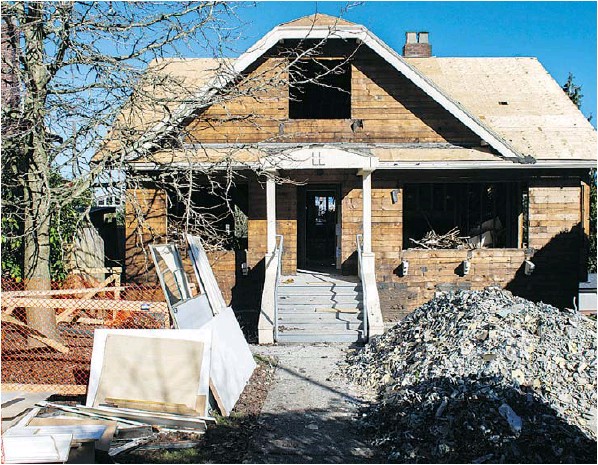

One of those developments is at 34 West 7th Ave., where Chard Development is redeveloping the former Far-Met Importers warehouse into a four-storey commercial strata development.

Set to break ground in May, the project will have 49,500 square feet of space. The new building will blend light industrial space on the bottom floor with more traditional office space above, said Byron Chard, the company’s chief financial and acquisitions officer.

The building used to have about 10 workers.

“We moved the company to South Burnaby,” said Matt Smith, the project’s leasing agent with Colliers International. “We sold them a strata unit down there because they were able to capitalize on the land value here in Mount Pleasant.”

He said Far-Met bought a high-ceiling building with lots of space for delivery trucks and ample parking.

Chard expects between 100 and 400 workers will soon toil in the new building, which is expected to be completed by the summer of 2018.

The building is being designed to suit the creative class that is emerging in the neighbourhood. “Light industrial could be a variety of companies,” Chard said. “It could go from manufacturing to basically anyone who makes widgets, essentially.”

The developers are trying to sell the units for $850 per square foot on average, Smith said.

“There’s just not really been a lot of strata available in the area,” he said. “Financing is incredibly favourable still right for owner-users. We’ve done a couple of deals, not just in this area, but at our Workspaces Strathcona project, where we’ve sold to owner-users who have got up to 100 per cent financing.”

Meanwhile, at 22 East 5th Ave., PC Urban is converting a Second World War-era industrial building into a six-floor tech and office hub. Built in 1942, the building once housed the Cemco Electrical Manufacturing Company, which made radio and radar components for the allied war effort.

That two-storey structure, now called the Lightworks Building, is becoming a 54,000-square-foot commercial building, while preserving the existing art deco facade.

When the project was announced at the end of 2015, PC Urban Principal Brent Sawchyn told Postmedia they expected to lease the space to high-tech tenants.

“A lot of the manufacturing today is intellectual property, so the Hootsuites of the world and the post-media production people like DHX Media and Image Engine, those are the types of people that are gravitating toward Mount Pleasant,” he said.

Colliers’ Smith said PC Urban and Chard were wise to get on the post-industrial wave now sweeping the neighbourhood. “They had the foresight to build these creative buildings that captured the demand and they appeal to those creative classes.”

Smith said that section of Mount Pleasant, between Main and Yukon streets, and Broadway and 2nd Avenue, has been in a long-term transition, with heavier industry giving way to more tech workers, artists, breweries and designers.

Residents of the area now include Hootsuite, and craft breweries such as 33 Acres, Faculty Brewing, and Gener8, a 3D effects conversion company.

“Heavy industrial users who don’t need to be in the downtown, they can be in other markets like Campbell Heights out in Surrey where they can get on the transportation routes there,” Smith said.

Last year, Hudson Plating, a chrome finishing company, left its space at 221-275 West 5th Ave. It now operates in Burnaby on North Fraser Way.

Smith said his firm recently sold that building and PC Urban has plans to redevelop it.

Most of land from Yukon to Main is zoned I1 for light industry to allow for more flexible use that folds-in higher density office space, said Russ Bougie, a principal with Avison Young. “You could produce movies, you could produce software, and you’re not necessarily producing hard goods.”

Bougie said the number of tenants looking for space in that area now outnumbers the buildings available for lease by nearly 10:1.

Michael Wiebe, a director of the Mount Pleasant Business Improvement Area, has mixed feelings about the changes in the area. He said projects like Chard’s and PC Urban’s are certainly bringing in new workers and residents to the area, which is welcomed, but the changes could also tamp down commercial diversity while eliminating cheaper, older work spaces.

“Vancouver needs to have those industrial type businesses as well,” he said. “We can’t move everything over to these tech companies. We have to have that mix. … I think the city needs to continue to evaluate their zoning process and make sure we can do a balance of both.”

He said space is still needed for artists, makers, and other small businesses that can’t afford to lease or buy space in the new projects.

“Small business is such a key component to a healthy neighbourhood and right now with all the changes and the price increase of land, it’s making it harder and harder for small businesses to start,” Wiebe said. “That’s something that could have a really long-term effect moving forward. That could really kill the neighbourhood.”

© 2017 Postmedia Network Inc.