Other

Archive for March, 2012

Further Mortgage Restrictions “Not Needed”

Thursday, March 1st, 2012Posted in Real Estate Related | Comments Off on Further Mortgage Restrictions “Not Needed”

What’s Hot in the Resale Condo Market

Thursday, March 1st, 2012Frank Schliewinsky

Other

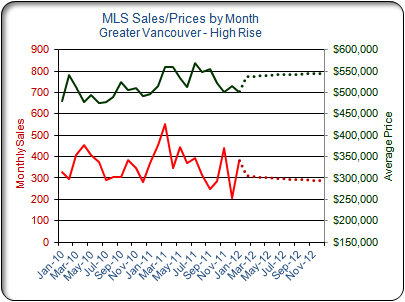

High Rise Market

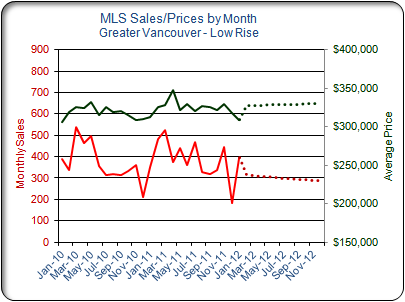

Low Rise Market

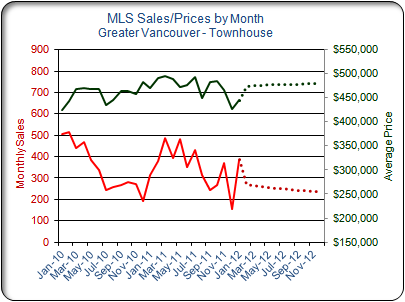

Townhouse Market

January MLS sales indicate that there will be a seasonal upswing in apartment and townhouse condo sales. But after the first quarter? The markets to watch are Westside Vancouver and Richmond.

Luxury high rise buyers are still active in the Westside MLS market and $million plus sales still make up over 20% of MLS high rise sales. If this number starts to drop in the coming months, it’ll be a sure indication that China’s troubled real estate market is starting to take a bite out of the high priced Vancouver market.

This may already be happening in Richmond. Both apartment and townhome MLS sales trends are down in Richmond and sales in January have not reversed this trend. Over the past few years, the Richmond market has grown on the strength of immigration to the Lower Mainland. With net migration figures to BC off by 8%, which could mean a 10% drop in apartment and townhouse demand, Richmond appears to be taking the brunt of the decline in apartment and townhouse demand.

High Rise Market

The 380 MLS high rise sales in January were almost the same as they were in January 2011 so a first quarter seasonal upswing appears to be in the cards.

But what happens to high rise sales during the rest of 2012 is still uncertain. The Westside Vancouver high rise market is still attracting well-heeled luxury buyers. More than 20% of the MLS high rise sales over the past three months had an average price of $1.2 million. However, January MLS high rise sales in Richmond are down sharply from one year ago. MLS sales in the Downtown high rise market in January were up, largely on strong sales of units under 600 square feet.

The average MLS selling price for high rise condos is still down from its high last July. The average selling price of $501,000 in January was up by 1% from 12 months ago. This may be an indication that in the year of the dragon, sellers will have difficulty in draggin‘ more money out of buyers.

Over the past three months the average high rise condo has taken 53 days to sell on MLS. Average selling prices have been 4% below the list price. Million dollar plus high rise units have had to drop their price by an average of 6% to make a sale.

Low Rise Market

January MLS low rise sales were up from 12 months ago and the 395 sales were better than in January 2011 or 2010. So the market is improving? Maybe. But the overall MLS low rise sales trend is still negative. MLS low rise sales trends in Burnaby and especially Richmond are down. The increase in January sales is largely on the strength of sales in Coquitlam-Port Moody-PoCo and North Surrey.

And product priced under $300,000 has made up most of the recent MLS low rise sales. The average MLS selling price for low rise condos in January was $309,000; down by 1% from 12 months ago.

At the end of January, the Greater Vancouver market had over 8,600 active low rise listings, so plenty of choice for buyers. The average low rise condo is taking about 58 days to sell on MLS. The average selling price is 4% below the list price.

Townhouse Market

MLS townhouse sales too, were up in January. The 386 sales during the month were up by 23% from 12 months ago largely on the strength of a sharp increase in North Surrey townhouse sales. North Surrey townhouse sales were over 100 units in January, something this market hasn’t managed to do in the past 18 months.

The average MLS selling price for townhouse condos in January was $445,000; down by 5% from 12 months ago. Most of the townhouses sold over the past three months are in the 1,250 to 1,750 square foot range but sales of smaller stacked units is quite strong. Sales of the smaller units could probably be better if there was more supply.

This Greater Vancouver Condominium Market Overview is compiled by Strategics, a Vancouver-based company providing information and analysis since 1981 helping to minimize marketing risk for apartment condominium developers, lenders, project marketers and investors.

© 2011 REW. All rights reserved.

Posted in Real Estate Related | Comments Off on What’s Hot in the Resale Condo Market

Buying with a friend or family

Thursday, March 1st, 2012Joint ventures can leverage into high-priced city real estate, but caution the byword

Other

Posted in Real Estate Related | Comments Off on Buying with a friend or family

Ski resorts, hotels, condos and fractional condos – high supply, stalled demand

Thursday, March 1st, 2012B.C. ski resorts stare down slippery slope of high supply, stalled demand from condo investors

GLEN KORSTROM/FRANK O’BRIEN

Other

British Columbia ski resorts may have reached the tipping point on the number of resorts needed – and any new developers will face financing challenges as investment condo sales whither. Such are the findings of a Western Investor look at a potential slippery slope facing mountain resorts.

The capacity debate is intensifying in the lead-up to a provincial government ruling on a proposed $450 million resort on Jumbo Mountain in the Kootenays.

Forests, Lands and Natural Resource Operations Minister Steve Thomson is expected to decide this winter whether to give Jumbo final approval.

But Grouse Mountain owner Stuart McLaughlin believes B.C. has more than enough ski resorts and that new ones will only erode existing operators’ bottom lines.

“We need current resorts to flourish,” McLaughlin said. “There’s lots of capacity in the system right now. Once all resorts are successful, that will create the need for more resorts and improve the likelihood of success for anyone who comes later.”

McLaughlin’s resort generated record revenue, in the $50 million range, in 2011. Success has largely come from adding attractions. For example, McLaughlin launched zip-lines in 2008 and spent several million dollars to build Grouse Mountain’s Eye of the Wind turbine and lookout, which opened immediately prior to the 2010 Winter Olympic Games.

Grant Costello, senior vice-president with proposed Jumbo Mountain developer Glacier Resorts Ltd., said his opponents are often ski resort operators who don’t want competition from what would be B.C.’s only year-round ski resort.

Costello has thus far cleared all obstacles in the way of his development, including a nine-and-a-half-year environmental review. He said he’s ready to start pumping tens of millions of dollars into creating the resort.

Sun Peaks mayor and longtime ski industry entrepreneur Al Raine likes Costello’s enthusiasm. “People who I’ve heard talking the loudest about how capacity at B.C.’s ski resorts should be held back are usually the existing operators,” he said.

“If someone is there with major investment money on a major resort and the project would help elevate B.C.’s international image in the ski business … let them go do it. We should encourage them.”

That sentiment formed the core of B.C.’s commercial alpine ski policy (CASP), which Raine helped write, and which the Social Credit government implemented in the 1980s.

That policy is also a key component of Jumbo’s business plan.

Ski resort operators say that CASP helped B.C. develop its ski sector into what is now more than a dozen resorts.

CASP has since expanded to become the all-season resort policy (ASRP), which includes non-ski operations. It allows developers who are willing to invest in infrastructure such as ski lifts to buy Crown land at the base of the mountain for the market price the land had before the infrastructure upgrade was installed.

Before CASP was enacted, ski resort developers were at the mercy of land speculators who bought land near potential developments.

The policy resulted in proposed developments moving away from areas where there was privately held land to sites where the base of the resort would be on Crown land.

“It really helped Kicking Horse Resort,” Raine added, referring to the Golden-area resort that was recently sold for $28 million. “That wouldn’t be there without this policy.”

But the policy doesn’t mean that all proposed resorts are given the green light.

The B.C. government approved Garibaldi Alpen Resorts Ltd.’s plans to develop a ski resort at Brohm Ridge in Mount Garibaldi Provincial Park in 2003. But BC Supreme Court judge Marvyn Koenigsberg overturned that approval later in the year, ruling that the government did not fully consult with the Squamish First Nation.

Raine was also the driving force behind developing a major mountain resort at Melvin Creek in the Cayoose Range between Pemberton and Lillooet. “I backed away from that. Land-use issues were unresolvable,” the 70-year-old said.

Hotel condos

But potential ski resort developers are also facing a financing challenge after what appeared to be a brilliant concept a few years ago – selling hotel units directly to investors – has turned to be a spectacular bust.

Neither fractional ownerships or hotel condominiums, both of which rely on individual buyers purchasing hotel rooms and then putting them into a rental pool, have proved profitable for investors.

“Every hotel condo investment [in B.C.] has lost money for the investor,” said real estate consultant Ozzie Jurock. “Every one.”

The crash has led to a giddy free fall in prices.

At Sun Peaks Ski Resort near Kamloops, some hotel condos that once sold for around $199,000 are now being offered at from $19,000 to $25,000 – with some selling for even less. The typical arrangement allows owners 56 days of use per year with the units potentially rented the rest of the time. The catch is that monthly fees for owners can easily top $360 per month and the owner receives less than half of any rental income, with the rest going to management. In most cases, rental incomes don’t cover the management fees.

At Whistler, hotel condos – known as Phase 2 units – are selling this year for less than they were in 1999, according to veteran Whistler realtor Mike Wintemute. Recent listings show one-bedroom Phase 2 suites at Whistler are priced as low as $61,000.

Fractionals

Fractional units, where resort hotel suites are usually sold in one-eighth to one-quarter shares, have also floundered. The most recent and highest-profile collapse is the luxury Parkside Resort and Spa in Victoria where one-eighth fractional shares were being sold from $115,000 to $121,000 last January. By November 2011, Parkside was in receivership with more than $61 million in unsold inventory, according to court filings by Victoria-based developer Aviawest Resort Group.

As Jurock explains, the problem with fractionals during a downturn is that eight owners will be all trying to sell the same unit at the same time.

“No one will build hotel condos or fractionals anymore,” predicted Zack Bhaista, vice-president of Mayfair Hotels and Resorts of Vancouver, which has just broken ground on the Crystal Blu Hotel in downtown Vancouver. “Anybody who bought a [shared ownership] hotel unit in the last 10 years has lost a tremendous amount of money,” he said.

from Western Investor March 2012

Posted in Real Estate Related | Comments Off on Ski resorts, hotels, condos and fractional condos – high supply, stalled demand